| Foundation | CPD: 7 hours | 1 day | Live |

Description

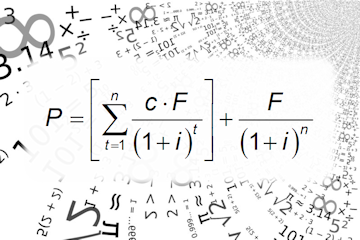

In our experience, some of those working in the financial markets are ill-at-ease with the mathematics underlying the products they are handling, and unsure how to apply even basic concepts like discounting, compounding, and present-value methods. Even if people are working with these products regularly, some may be uncomfortable about the way in which prices are derived, how sensitive these prices are to market forces, and how they should properly deal with variations to standard products.

After attending this practical seminar, participants will have mastered the concepts, theory, and practices of bond mathematics, be confident in pricing and valuing a diverse range of fixed income and related financial products, and understand exactly what makes these products tick.

Learning Outcomes

By attending this course, you will:

- Become completely familiar with the concepts of bond math

- Understand the theory underlying the pricing and valuation of fixed income and related products

- Be completely comfortable in applying these concepts in practice

- Obtain first-hand experience of each area through interactive workshops, case studies, intensive simulations, and powerful computer analytics

Who Should Attend

Anyone working in the fixed income market.

Prerequisites

None

Book Now!Seminar Content

Time Value of Money

- Using a financial calculator and RPN

- Time value of money

- Present and future values

- Interest and discount factors

- Simple vs.compound interest

- Discounting and compounding

- Annuities

- Discounted cash flows

- Net present value

- Internal rate of return

- Partial interest periods

- Discrete vs.continuous compounding

- Nominal vs.effective interest yields

- computer TVM workshop

Understanding the Yield Curve

- Definition of the yield curve

- The normal yield curve

- Liquidity and expectations hypotheses

- Up and downward sloping yield curves

- Yield curve strategies and plays

- Riding and trading the yield curve

Market Mathematics: Money Market Instruments

- Discount vs.coupon securities

- Pricing discount instruments(e.g.bills,BAs,CP)

- Discount quotations

- Add-on yield quotations

- 360-and 365-day bases

- Pricing interest-bearing instruments

- Money-market and bond-equivalent yields

- Frequency of compounding

- Compound effective yield

- Holding-period return

- computer Money-market workshop

Market Mathematics: Fixed Income Securities

- Pricing coupon securities

- Price and yield

- Gross and net redemption yields

- Day-count conventions

- Accrued income

- Clean and dirty prices

- Current yield vs.yield-to-maturity

- Re-investment of coupons

- Holding-period return

- Price sensitivity concepts

- Duration,volatility,and convexity

- Calculating duration and convexity

- Modified duration

- Using duration to measure bond price sensitivity

- Applying convexity for large yield shifts

- Using duration to manage investment returns within a given horizon

- Duration and convexity of a bond portfolio

- Characteristics of bullet and barbell portfolios

- Using duration to design portfolio hedges

- computer Fixed income workshop

Market Mathematics: Corporate Bonds

- Corporate bonds

- Bond rating and rating agencies Corporate bond spreads

- High-yield bonds

- Sinking funds and other provisions

- Bonds with embedded options

- Floating rate notes(FRNs)

- computer Corporate bonds workshop

When and Where

1 Jun 2026

09:00-17:00

New York

Markets

Book Now!

Other Dates and Locations

Search for Bond Math in our course schedule for alternative dates and locations where this course is offered.