| Intermediate | CPD: 14 hours | 2 days | Live |

Description

The FX Options Masterclass is an intensive and practical seminar aimed at those who are familiar with vanilla FX options but want to master the more advanced features like vanna / volga pricing and exotics.

After attending the program, participants will have mastered the complexities of vanilla and exotic FX options, and will return able to use these products confidently to manage FX risk or to exploit sophisticated directional, positional, and volatility views.

Learning Outcomes

By attending this course, you will:

- Understand the principles used in the active hedging of FX options and portfolios, and the practical problems faced by traders in managing a book of FX options

- Examine FX options in greater depth, especially how the volatility smile and skew influences FX option prices

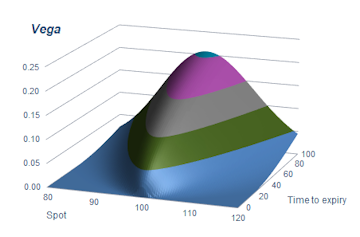

- Explore second-order Greeks like vanna and volga, and their impact on FX option premiums

- Investigate the practical use of exotic, non-standard, and second-generation options.

- Study barrier and digital options in greater depth, including their practical use by clients, and the peculiarities of their Greeks

- See how exotic FX options can enrich the range of possibilities for hedging or for exploiting specific views

- Obtain first-hand practical experience with computer-based strategy evaluation, graphics, analytics, option pricing, and simulation

Who Should Attend

Anyone familiar with vanilla FX options working in FX risk management, currency sales and trading, companies with multi-currency operations, or those advising clients on managing their FX risk.

Prerequisites

A good working knowledge of vanilla FX options.

Book Now!Seminar Content

Delta Hedging – Theory and Practice

- Exactly how delta-hedging works

- Why be delta-neutral?

- Buying high and selling low to achieve delta-neutrality

- The link between delta and gamma

- The cost of being negative gamma

- The benefit of being positive theta

- The link between gamma and theta

- The trade-off between implied volatility and experienced volatility

- "Easy" and "difficult" options to hedge

- Gamma hedging

- Transactions costs

- Market gapping problems

- P&L risks while running an options book

- The cost of hedging and running an options book – implications for clients

- computer Delta-hedging simulation

FX Options – A Deeper Insight

- The delta-symmetric strike price

- Calculating strike prices from deltas

- Sticky delta vs. sticky strike

- Risk reversals, butterflies, and the volatility smile/skew

- computer Calculating the smile from flies and risk reversals

- Trading flies to position for smile

- Trading risk reversals to position for skew

- Implications of smile and skew for FX option buyers

- Spot delta vs. forward delta

- Dual delta and dual gamma

- Vanna – dVega/dSpot and dDelta/dVol

- Volga – dVega/dVol

- Implications of vanna and volga on hedging costs, and on FX option premiums

- Vanna-volga pricing demystified

Overview of Exotic FX Options

- Introduction to exotic options

- A taxonomy of exotics

- Path-dependent options

- Options with step-like (singular) payouts

- Everyday exotics: barriers and digitals

- Correlation options: baskets, rainbows, outperformance, quantos, and others

- Other exotics: compound, average rate (Asian), contingent, forward-start

- Volatility and variance FX swaps

Barrier Options

- Up, down, knock-in, and knock-out – variations on a theme

- Barriers with rebates

- Normal and partial barriers

- Single, double, and multiple barriers

- Outside barriers (dual factor)

- Curvilinear barriers

- Practical issues in monitoring the barrier

- Barrier running

- Practical applications for barrier options in hedging FX risk

- computer Barrier Option Pricing Workshop

- computer Using FX barrier options

Greeks for Barrier Options

- Nature of delta for KO options

- Nature of delta for KI options – why they hedge backwards

- Nature of gamma and vega for KO and KI options

- Delta changing at the barrier

- Gamma at the barrier

- Delta-hedging near the barrier

- Delta-hedging at the barrier

- Nature of delta, gamma, and vega for RKO and RKI options, or...

- Why does my call option have a delta of minus 23?

- Risks of RKO and RKI options

- computer Risk characteristics of barrier options

- Implications for clients buying FX barrier options

Digital Options and the "Digital Cookbook"

- One-touch, all-or-nothing – variations on a theme

- Cash-or-nothing and asset-or-nothing

- Digital options as a basic building block

- Creating a pay-later option

- Creating a reverse contingent option

- Creating a "money back" option

- Creating a stepped-premium option

- Creating enhanced-rate synthetic forwards

- computer Digital Options Pricing Exercises

- computer Using Pay Later Options

Greeks for Digital Options

- Nature of delta for digital options

- Nature of delta for NT, DNT, and DOT options – why they sometimes hedge backwards

- Nature of gamma and vega for NT and DNT options

- Delta changing at the trigger(s)

- Gamma at the trigger(s)

- Delta-hedging near the trigger(s)

- Delta-hedging at the trigger(s)

- Risks of writing digital options

- Digitals near the trigger(s) near maturity, or...

- Why does my pricing system tell me I need to sell $3 billion to re-hedge this option?

- computer Risk characteristics of digitals

- computer Adjusting FX option prices for vanna/volga

Putting it All Together

- Review of structures, barriers, and digitals

- Combining exotics with vanilla options

- Embedding options within a package

- Designing innovative solutions

- Reducing the cost of hedges by precisely tailoring the hedge to match the need

- computer Exotic options client structuring exercise

When and Where

15 Jun 2026 - 16 Jun 2026

09:00-17:00

London

Derivatives

Book Now!

Other Dates and Locations

Search for FX Options Masterclass in our course schedule for alternative dates and locations where this course is offered.